atc income tax india

All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Central Board of Revenue Act 1963 Charitable And Religious Trusts Act 1920 Charitable Endowments Act. The average salary of a JE ATC can be approximated to INR 65000 approx.

Checklist For Indian It Professionals Filing Individual Income Tax Returns Aotax Com

Section 80C of the Income Tax Act Tax Deduction up to Rs.

. Chapter XIV Sections 139 to 158 of the Income Tax Act 1961 deals with the provisions related to procedure for assessment. Public Provident Fund PPF PPF is a great tax saving option as it qualifies for deduction upto Rs 15 Lakhs per annum under section 80C of the Income tax act. Welcome to Your Publishing Site.

With so few reviews your opinion of ATC Income Tax could be huge. At least one off day per week for tax preparers. Payroll issues are adressed quickly as well as any other issues.

I will explain all these factors which affect the total salary of any ATC Officer in AAI. Good company with good pay and incentives. A maximum of upto 10 of salary for employees or 20 of gross total income for self-employed individuals.

4 Subject to the provisions of sub-section 6 where the source of any receipt deposit or investment in any assessment year is claimed to be an amount added to income or deducted while computing loss as the case may be in the assessment of such person in any year prior to the assessment year in which such receipt deposit or investment appears hereinafter referred. Additionally it has provided decent returns in the 7 9 range. The Government of India with the help of these taxes invests in the betterment of the infrastructure and technology of the nation which ultimately leads to its.

The Indian Monthly Tax Calculator is updated for the 202223 assessment year. ATC is a premier tax preparation firm with a core focus in tax services. You can calculate your Monthly take home pay based of your Monthly gross income Education Tax NIS and income tax for 202223.

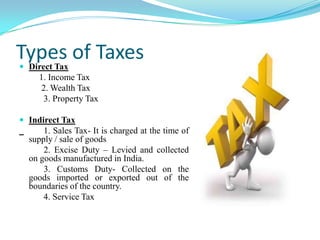

As the name suggests this type of. Any individual or HUF can get a tax deduction up to Rs. Owners are friendly and easy to work for.

These fixed deposits are available in two types. 15 Lakh हद म पढ. 1000 USD although it depends on various factors.

Income Tax is one of the major elements behind the financial economy of the country. Multi Location Business Find locations. Income-tax Return Forms for Assessment Year 2022-23.

ATC is a premier tax preparation firm with a core focus in individual and small business tax services. This type of fixed deposit is held by a single person and the investor can claim the tax deduction for his investment in fixed deposit. 21 This Act may be called the Income-tax Act.

250000 Nil Nil Rs. ATC Income Tax offers exceptional tax service in Atlanta Milwaukee area while specializing in Refund Advance options. 15 lakh per financial year under Section 80C of the Income Tax Act and its allied sections such as 80CCC and 80CCD.

Start your review today. Recently we have discussed in detail section 150 Provision for cases where assessment is in pursuance of an order on appeal etc of IT Act 1961. As evident from the above table the basic pay of.

Since PPF is backed by the government it is one of the safest investment cum tax saving options in India. 12500 whichever is less. This deduction is not available to partnerships companies and other.

All tax returns are backed by our Triple-A Promise. Tax deductions under Section 80CCD are categorised in three subsections. Non-resident individualHUF Net income range Income-tax rates Health and Education Cess Up to Rs.

Find your nearest ATC Income Tax offices and make an appointment today. Tax Preparer Current Employee - Decatur GA - February 12 2015. With over 35 years of industry experience our team has a broad understanding of the tax code and.

Tax on the income earned which is payable to the Government of India at the end of each financial year is known as Income Tax. Pay every 2 weeks. The amount of rebate is 100 per cent of income-tax or Rs.

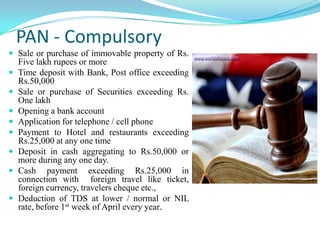

It is deductible from income-tax before calculating education cess. CBDT extends last date for filing of Form No10AB for seeking registration or approval under Section 10 23C 12A or 80G of the Income-tax Act 1961 the Act Press Release. Business Profile for ATC Income Tax.

Use the simple monthly tax calculator or switch to the advanced monthly tax calculator to review NIS. Employee Contribution Under Section 80CCD 1. Section 151 of IT Act 1961 provides for sanction for issue of notice.

INCOME-TAX ACT 1961 43 OF 1961 AS AMENDED BY FINANCE ACT 2008 An Act to consolidate and amend the law relating to income-tax and super-tax BE it enacted by Parliament in the Twelfth Year of the Republic of India as follows CHAPTER I PRELIMINARY Short title extent and commencement. The limit is capped at 15 lakh aggregate of 80C 80CCC and 80CCD. About the Monthly Tax Calculator.

These links will help you get started. The holder of a tax-saving fixed deposit can get a tax deduction of a maximum of Rs.

Atc Accounting Tax Consultants Business Management Consultant In Bhatagaon

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

How Is Taxable Income Calculated

What Is The In Hand Salary Of A Newly Recruited Aai Je Airport Operations Quora

Air Traffic Controller Salary In India Aai Atc Salary

What Is The Income Tax Slab Rate For Ay 2020 21 Quora

What Is The Income Tax Slab Rate For Ay 2020 21 Quora

Incometax Twitter Search Twitter

How Is Taxable Income Calculated

Incometax Twitter Search Twitter

Incometax Twitter Search Twitter

Incometax Twitter Search Twitter

Incometax Twitter Search Twitter

Atc Income Tax Reviews Photos Phone Number And Address Legal Services In Georgia Nicelocal Com